Okay, let's get one thing straight: anyone who's surprised the market's doing the tango with disaster hasn't been paying attention. We're talking about the S&P 500 ETF (SPY) and the Nasdaq 100 ETF (QQQ) both taking a nosedive, all because...wait for it...economic data is delayed? Give me a break. Stock Market News Review: SPY, QQQ Slump on Economic Data Disruption as VIX Surges 15%

"The Democrats may have permanently damaged the federal statistical system," says White House Press Secretary Karoline Leavitt. Oh, really? Blame the other guys, as always. As if the system wasn't already rigged. And honestly, who even trusts those numbers anyway? It's all cooked, I tell ya.

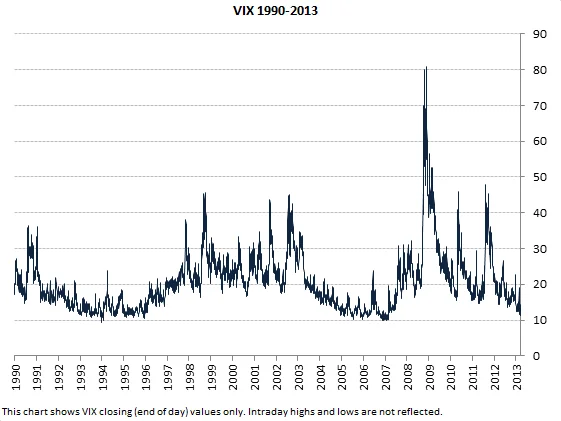

Volatility is back, baby! The VIX is up 15%, which means the sharks are circling. And CNN’s Fear and Greed Index? Plunged into "extreme fear." Well, duh. What did you expect when the whole damn economy is built on sand?

I swear, it's like watching a bunch of lemmings run off a cliff, except these lemmings are wearing suits and yelling about "market corrections." And the Fed? Don't even get me started.

So, the Fed's waffling on rate cuts because, surprise, inflation is still a thing. They're worried about keeping prices down, which means jacking up interest rates. But higher rates mean businesses can't borrow, which means...layoffs.

Speaking of layoffs, Challenger, Gray & Christmas reported over 153,000 job cuts in October. That's the highest since 2003. You know, back when things were totally awesome.

Wall Street Journal chief economics correspondent Nick Timiraos notes that four Fed presidents aren't "actively agitating for a December rate cut." Actively agitating? What is this, a political rally? They're supposed to be, ya know, managing the economy.

And the odds of a rate cut in December? Down to a coin flip, which is about as reliable as a psychic reading. But is a rate cut really the answer? Maybe we need a full system reboot. Burn it all down and start over. Then again, maybe I'm the crazy one here.

Oh, and here’s a fun fact: Someone’s pushing the ProShares Short VIX Short-Term Futures ETF (SVXY), designed to give investors "short exposure" to the Volatility Index. Basically, it's betting against volatility. Which, in this climate, is like betting against gravity. Suicidal, really.

Monte Independent Investment Research – some buy-side equity analyst nobody's ever heard of – claims to have expertise in like, everything. Tech, energy, industrials, materials… Give me a break. Jack of all trades, master of none, I say. Sounds like another shill trying to pump up a failing stock.

It's all a house of cards. The economy, the market, the whole damn thing. It's built on debt, lies, and the blind faith of people who should know better. The market's not having a meltdown; it's having a long-overdue reckoning. Maybe, just maybe, this is the wake-up call we needed. Or maybe it's just the beginning of the end. Either way, I'm stocking up on popcorn. (And whiskey.) There is a typo, by the way, in the previous sentence: "stocking up on pop corn".